Will Ron Paul-onomics beat Obama?

The race for the White House is in full swing with the top two candidates for the Republican nomination -- Newt Gingrich and Mitt Romney -- exchanging body blows like bloodied boxers.

But it's dark horse Ron Paul who seems to be tapping into the deep-seated cynicism with which many Americans view the economy, the prolonged downturn and how we can stop the boom-and-bust cycle.

His top target: The Federal Reserve. His solution: "End the Fed" and return to the gold standard.

.jpg)

How do I know this is catching on? Well, Gingrich, looking to expand on his win in South Carolina and attack Romney from the populist angle, is now embracing some of Paul's economic libertarianism. Last Friday, he announced that, if elected president, he would create a new commission on gold to "look at the whole concept of how do we get back to hard money" and how we can ensure the dollar is "worth 30 years from now what it is worth now."

Anthony Mirhaydari

The move could be a master stroke if it fires up the Tea Party base and wins over Paul voters. And it could provide a valuable weapon if the eventual GOP nominee seizes on it as Republicans try to defeat President Barack Obama. Could the gold standard ever come back?

Taking on power and money

Monetary reform challenges the very center of the Wall Street/Washington power nexus so many dislike. Occupy Wall Street protesters have looked with anger at the $7.7 trillion the Fed committed, behind closed doors, to save big, over-bonused and bailed-out banks. The Tea Party gets angry when Fed policymakers push the government toward bailing out the housing market and Miami condo speculators.

All are tired of the Fed's monetary policy experiments, its bouts of quantitative easing, a monetary base that has gone from $800 billion to nearly $2.8 trillion in the past few years, and the bouts of inflation in commodities such as gas and food that result from all this. Many realize that it was the Fed's mistaken obsession with the risk of deflation -- falling prices -- and its overconfidence in its own abilities that incubated the housing bubble, starting in 2003, and led it to deny anything was wrong as the bubble started to burst in 2007.

Everything that's happened since has been an effort to reverse that original mistake. The megabanks have been given cash at almost no cost, and play money has been pumped into Wall Street on the misguided hope that lower borrowing costs and higher stock prices will increase economic growth.

The strategy staved off catastrophe when it was first deployed in 2008 and early 2009. Now, however, it's just making things worse.

Can't the Fed see it's not working? We can

The problem is that more debt and currency debasement isn't the solution in an era of tight commodity markets and of deleveraging (the process of shedding household and business debt). The $600 billion "QE2" initiative, which ended last summer, merely pumped up oil prices and cut consumer spending. Those levers had been pulled by former Federal Reserve Chairman Alan Greenspan and President George W. Bush to inflate us out of the 2001 downturn; they would not work again so soon.

The American people realize that what the Fed and Washington are doing isn't working and that the policy elites are on a dangerous course. And the people are willing to consider dramatic moves, such as tying the dollar to gold once again.

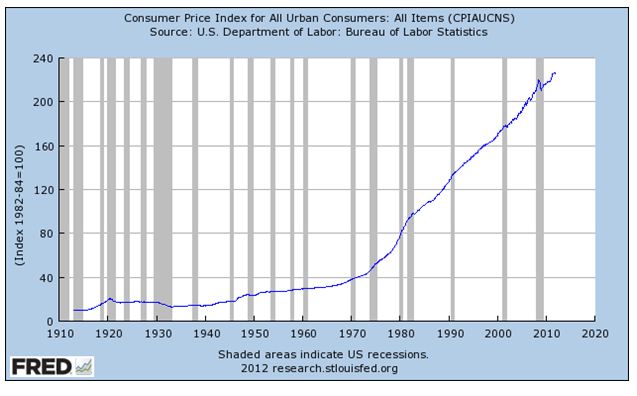

Consider the longer term, too: The dollar has lost 85% of its value since President Richard Nixon and ended the de facto gold standard under the postwar "Bretton Woods" global exchange-rate regime. Under the true gold standard, which lasted from 1834 to 1914 (save for the Civil War years), the power of the dollar remained steady.

The chart above of consumer price inflation going back to 1913 tells you all you need to know. Once the dollar was unleashed from gold in '71, the Fed was no longer constrained. Prices surged as new money was freely printed.

No wonder what we might call "Ron Paul-onomics" is resonating. A Rasmussen poll conducted last October found that 44% of Americans favor a return to the gold standard, with 28% opposed. That goes up with the belief that the change would to sock it to "the man": When those surveyed were told the move would "dramatically reduce the powers of bankers and the political class to steer the economy," support jumped to 57% while opposition dropped to 19%.

Evidence is building that we need a hard reset to harder money and a refocusing on the structural problems we face, from an inefficient health care system driving the government's long-term deficit to a trade policy that allows Asian mercantilists to take advantage of blue-collar American workers.

But make no mistake: It would be a painful change, maybe too much for the country to handle.

Hard problems for hard money

The heavily indebted farmers clamoring for bimetallism and easier money in the Reconstruction Era after the Civil War understood the difficulty of repaying debts in the strong-dollar environment then favored by big business. Let the dollar's value slip, and their debts would be easier to repay.

Current political realities suggest a dramatic restoration of the dollar's convertibility into gold or silver -- designed to end inflation and keep the dollar's value steady -- isn't in the political cards for this reason. The nation is saddled with far too much debt, public and private.

There are also technical problems that ruined the legacy of the gold standard and deepened the Great Depression -- many of which current Fed chairman Ben Bernanke has studied (.pdf file).

But the goals beneath the calls for the gold standard -- the desire to end monetary shenanigans and restore the dollar's stability -- are still achievable.

And these issues are sure to hound Obama this year, especially if the Fed, as Wall Street expects, unleashes another round of quantitative easing this spring. With the central bank seeming to come to the president's rescue with economic stimulus and the government's huge budget deficit, Republicans will be livid. Obama, desperate to boost the economy before polls open in November, will want to talk about something else.

Red rates?

At issue is the fact that interest rates, which reflect the supply-demand balance for money and are a major driver of the overall economy, are determined by what to some sounds like central planning of the type deployed by the communists in Beijing or Havana. Ron Paul reflected on this point Monday in the Republican presidential debate when he said borrowing costs are determined by "a bunch of guys in secret deciding what interest rates should be."

Compare this with how the Fed operated on the gold standard: Interest rates were determined by things like savings rates, investment returns and our balance of trade with foreign countries. In other words, it was based on rules and the free market.

And it mostly worked. We had more frequent but shallower recessions that kept banks and businesses from making poor investments as the ups and downs of the economic cycle became facts of life instead of an existential menace. After all, for capitalism to work there must be the fear of failure. Otherwise, it's like having religion without sin.

This gets to the heart of an important debate that's been under way for years among top economists: What should the Fed's mandate be? Right now, it has policy discretion, a short-term outlook and a dual mandate to keep both inflation and unemployment low. This creates volatility as the Fed goes from worrying about growth (as it did in the 1960s and 1970s) to worrying about inflation (as it did in the 1980s) to worrying about growth (as it did in the 2000s).

A new, harder-dollar standard

Two respected Fed-watching economists I spoke to this week, "A History of the Federal Reserve" author Allan Meltzer and Stanford economist John Taylor, believe we need the opposite from the Fed: rules-based decision making, a long-term outlook and a single mandate to control inflation. And they know how to get it done.

These goals, while satisfied by the gold standard, are also satisfied by a rule-based approach Taylor created that has since been dubbed the "Taylor Rule." It's an equation that targets a specific interest rate based on inflation and how quickly the economy is growing relative to its potential, which acts as a speed limit. Go too fast, you get inflation. Go too slow, you get unemployment.

Using the Taylor Rule would've kept interest rates higher during the 2003-2005 period when the housing bubble took root. And right now, the Taylor Rule suggests short-term interest rates should be around 0.5% instead of near 0%. In other words, the Fed should be holding its fire -- not preparing another money dump.

Moreover, and not to get too technical, but if, as I believe, the economy has suffered damage to its potential growth rate because of long-term joblessness and the like, then interest rates should be set even higher to prevent inflation. (Taylor himself discusses the Taylor Rule in the fourth chapter of his new book, "First Principles.")

The time for action is now. Meltzer warned me that it's not just Ron Paul-types who are angry at the dilettantes playing with the dollar. Over the past few months, some $85 billion worth of U.S. Treasury debt has been sold by investors in the Chinese and Japanese governments. While the overall amount is a pittance compared with the $15.2 trillion in government debt outstanding, it represents a sea change.

His contacts in the halls of power tell him the Asians are worried America is on the path to a Great Inflation. In other words, the dollar is in serious trouble.

The impact until we reform

Still, no one seems to believe that serious monetary policy reform with bipartisan reform will be coming out of Washington anytime soon. That's already not happening on much easier issues.

But until reform happens -- ideally, something that ties the Fed to an inflation-only mandate (like the European Central Bank) to be conducted using a Taylor Rule-like approach -- the dollar will continue its long, downward path and inflation will continue to rage. The fall will be punctuated by multimonth rises whenever something goes bump in the world, be it eurozone debt problems or geopolitical tension. After all, (for now) we still issue the world's reserve currency of choice; for all its problems, the dollar seems better than anything else.

Another leg down appears to be getting started now as calls for a QE3 round of Fed money printing grow louder. That's causing precious metals, the classic anti-dollar play, to perk up. Silver in particular is showing strength as the more speculative, flashier alternative to gold. I talked about this in a recent blog post recommending the iShares Silver Trust (SLV +1.63%) exchange-traded fund.

To be sure, talk of potential growth rates, dual mandates and the Taylor Rule makes for an arcane discussion better suited to the professors' lounges of economic departments than dinner tables in Iowa and South Carolina.

But the gold standard works well as a rallying cry with broad appeal as presidential hopefuls look to tap into the discomfort that the Fed has overstepped its bounds, is fanning the flames of inflation and is in league with Wall Street titans. And because this debate is the key to the economic deliverance we all seek, I say the more people who talk about it, the better.

And the stakes are high. If the Fed ignores what the Taylor Rule suggests and unleashes QE3 in the months to come, expect a wave of anti-Fed, pro-dollar sentiment. I'm convinced this will make Obama a one-term president and push the Republican nominee to victory.

I'd bet a gold dollar on it.

At the time of publication, Anthony Mirhaydari did not own or control shares of any fund mentioned in this column.

Meet Anthony Mirhaydari at the MoneyShow

You're invited to join MSN Money columnist Anthony Mirhaydari and dozens of other investing experts in February at the world's largest investment and trading conference, designed to help you get through an increasingly difficult market. The World MoneyShow Orlando takes place Feb. 9-12 at the Gaylord Palms Resort in Orlando, Fla., and admission is free for MSN Money readers. Register here today.

Be sure to check out Anthony's new investment advisory service, the Edge. A two-week free trial has been extended to MSN Money readers. Click the link above to sign up. Mirhaydari can be contacted at anthony@edgeletter.com and followed on Twitter at @EdgeLetter. You can view his current stock picks here. Feel free to comment below.

http://money.msn.com/investing/will-ron-paul-onomics-beat-obama-mirhaydari.aspx?page=0