THE 'CATASTROPHIC SHUTDOWN OF AMERICA'S SUPPLY CHAIN' BEGINS: STUNNING PHOTOS OF WEST COAST PORT CONGESTION

Tyler Durden

One week ago, when previewing [13]what may be the first lockout of the West Coast Ports since 2002, we cited the Retail Industry Leaders Association [14]who, realizing that failure to reach an agreement between the dockworker union and their bosses, the Pacific Maritime Association representing port management would lead to devastating consequences for the US retail industry, had several very damning soundbites:

- "a work slowdown during contract negotiations over the past seven months has already created logistic nightmares for American exporters, manufacturers and retailers dependent on an efficient supply chain. A complete shutdown would be catastrophic, with hundreds of thousands of jobs at risk if America’s supply chain grinds to a halt."

- "A west coast port shutdown would be an economic disaster."

- "A shutdown would not only impact the hundreds of thousands of jobs working directly in America’s transportation supply chain, but the reality is the entire economy would be impacted as exports sit on docks and imports sit in the harbor waiting for manufacturers to build products and retailers to stock shelves."

And the punchline: "The slowdown is already making life difficult, but a shutdown could derail the economy completely."

Just so readers have a sense of what is at stake, this is what the average dockworker makes: $147,000 a year in salary, plus $35,000 a year in employer-paid health care and an annual pension of $80,000 (according to an association press release). It is the overtime compensation to the total shown here, which grosses to over a quarter of a million dollars, that dockworkers are negotiating to raise or else the key US supply-chains gets it.

Incidentally, the demands of the dockworker union and their leverage is precisely the reason for the dramatic discrepancy we showed in the following chart [15]:

In any case, as of last night, the choking of the US supply-chain has officially begin, when as the LA Times reported [17]last night, "West Coast ports — including the nation's busiest in Los Angeles and Long Beach — will partially shut down for four days as shipping companies plan to dramatically slash dock work amid an increasingly contentious labor dispute."

More:

Terminal operators and shipping lines said that they would stop the unloading of ships Thursday, Saturday, Sunday and Monday, because they don't want to pay overtime to workers who, they allege, have deliberately slowed operations to the point of causing a massive bottleneck. Thursday is Lincoln's Birthday and Monday is Presidents Day, which are holidays for the workers.

Slowing down work "amounts to a strike with pay, and we will reduce the extent to which we pay premium rates for such a strike," said Wade Gates, spokesman for the Pacific Maritime Assn., the employer group representing the shipping companies. The local union in Los Angeles and Long Beach has denied using slowdown tactics.

Accoring to the LA Times, it is not clear if the partial shutdown foreshadows a total closure of the ports. Fears of a lockout of dockworkers, who have been without a contract since July, have risen in the last week and the two sides haven't held talks since Friday. SF Gate [18]was far more clear on what the dockworker action means: "West Coast ports to shut down 4 days amid labor dispute [18]."

Work delays and stoppages over the past three months have caused mounting problems for Bay Area importers and small-business owners, who say they are losing money as trucks line up daily outside the Port of Oakland waiting for container ships anchored in San Francisco Bay to unload.

The shutting down of port operations is ironic because it’ll make the situation worse, said union officials who claimed the association canceled a negotiating session Wednesday and has not been available since last Friday.

“This is an effort by the employers to put economic pressure on our members and to gain leverage in contract talks,” said Robert McEllrath, president of the longshore and warehouse union. “The union is standing by ready to negotiate, as we have been for the past several days.”

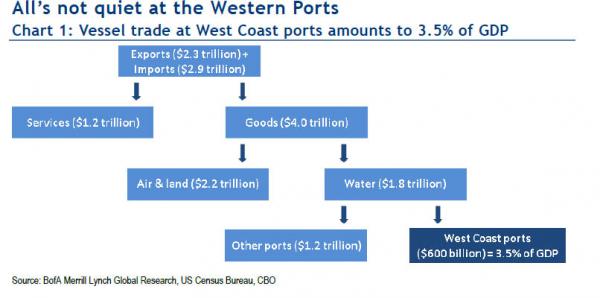

Regardless of who is at fault for the (partial) shut down, one can't blame dockworkers for doing what Greece is actively doing at the same time in its own negotiations with Europe: maximizing its leverage. Because as Bank of America showed yesterday, in a piece dedicated precisely to this topic, nothing short of 3.5% of marginal US GDP is at steak, which translated into CAGR terms, means that the fate of America's estimated 3% growth in 2015 is suddenly in the hands of a few thousand port workers, and with that, whether or not the US has a recession.

Some more thoughts from BofA:

Could port activity grind to a halt?

Due to continued unsuccessful contract negotiations between West Coast port employers (Pacific Maritime Association) and workers (International Longshore and Warehouse Union), there is a growing risk of a shutdown/lockout at West Coast docks, possibly within days. This past weekend, ports temporarily halted operations, adding to uncertainty. In our view, although a port strike/lockout could weigh on operations and profitability in some industries, the economic fallout of a one-week strike is likely to be limited to a loss of $0.8-1.8bn, representing a 0.1-0.2% hit to annualized GDP growth in 1Q15.

Size matters

Since the fall, a notable disruption in activity at the ports has materialized, and the risk is the current delays could spiral into full-blown gridlock, or that employers could lock out workers. West Coast ports are an important component of US trade. As cited by our Transportation Analyst Ken Hoexter, the value of total traffic at West Coast ports (waterborne, air and land) accounts for 12% of GDP. However, drilling down specifically to goods arriving/departing by water vessels (and hence, impacted by the labor dispute) reveals a much smaller share, only 3.5% of GDP or roughly $600bn, as of 2014.

Gauging the economy-wide risk during a shutdown

The economic fallout of a port shutdown is challenging to measure and depends heavily on the technique of analysis. Economic impact studies of West Coast port shutdowns have yielded loss estimates as high as $2bn per day. However, analysis by Peter Hall of the University of Waterloo and by the US Congressional Budget Office criticized such techniques as they fail to account for the ability for firms to substitute to alternative transportation routes, resulting in inflated loss estimates. Instead, according to research published by the CBO in 2006, the fallout is likely much lower, roughly $65mn to $150mn per day if Los Angeles and Long Beach ports were to shut down for a week in 2004. To get a sense of what the risks are in today, we gross that figure up to account for higher trade volumes, and include all West Coast ports. Our back of the envelope calculation suggests the daily loss to GDP would be $150-350mn per day, or $0.8-1.8bn per week. That would represent 0.1-0.2% hit to annualized 1Q15 GDP growth.

Learning from the past: short-term pain is likely

If history is any guide, a temporary port shutdown would acutely hurt the trade sector in the short term, but would not threaten to derail the recovery. In 2002, port workers at 29 West Coast ports were locked out for roughly 10 days in October, before President Bush invoked the Taft-Hartley Act to reopen the ports.

What could go wrong?

We highlight two key scenarios that may lead to greater downside risk relative to our base case:

- A protracted disruption could trigger non-linear (accelerating) economic costs as temporary contingency measures run their course, resulting in worsening supply chain disruptions. President Obama could intervene by invoking the Taft-Hartley Act as was done in 2002, but it is not clear if or how quickly the White House would be willing to step into a labor dispute this time around.

There is uncertainty regarding the capacity of alternative transportation routes. Extensive use of air freight and Canadian/Eastern ports may lead to capacity constraints at those sites, limiting the ability of industry to successfully substitute to alternative supply chains for an extended period.

So the bottom line is that nobody really knows what will happen if the "partial" stoppage becomes a permanent one, as dockworkers try lever their influence on the US economy (which according to financial comedy TV is so strong, it should have no problem to meet their demands, right?), but it is safe to say that the final outcome will be somewhere between the "catastrophic" devastation for the economy which the retail industry predicts, and anywhere up to a 3.5% hit to the GDP, which in turn means an economic recession, if only temporary.

One thing, however, about which there is no doubt at all, is the unprecedented congestion that has slammed the Port of Los Angeles and Long Beach harbor: that is very much real, as can be seen on the series of photos below courtesy of Mike Kelley. From his blog [20]:

As anyone who follows my work knows, I'm fascinated by industry and infrastructure. For the past few weeks, a labor dispute has been unfolding at the Port of Los Angeles and the Port of Long Beach. After flying over the area while coming in to land at LAX, I saw all of these giant container ships anchored offshore and instantly knew that I had to photograph it.

The next day I called my pilot and said 'when is the soonest we can go up?!' Less than 24 hours later we were in the air. It was one of the most exciting experiences I've had doing aerial photography - being that far out at sea, with the huge swells underneath you, and these massive, massive container ships everywhere was like living a scene out of Walter Mitty's life.

Cargo ships have been backed up for weeks on end at the ports of LA and Long Beach amid a labor dispute.

VIEW ALL STUNNING PHOTOS!

http://www.zerohedge.com/print/501814

.jpg)